Irrational dumb/corrupt money managers.

A critique of 95%+ money managers and funds who largely underperform or barely keep up with the broad market indices long-term.

Philosophically I put myself in the category of value investors. It is what makes most sense to me as a framework of investing. For a better introduction to the philosophy for those who do not understand it well, consider going through everything that Mr. Buffett or Mr. Munger had ever said or wrote about business. If you don’t have that much time, maybe consider skimming through my first article on this substack - Irrational investment philosophies. But largely what I or other value investors believe in is that the stock market being auction driven in nature sometimes misprices different assets like stocks(part ownership of businesses) or bonds from the perspective of the long-term private business owner. To that extent, given we are net buyers of pieces of paper(stocks/bonds) on the asset side, we are no different from the ladies where something is triggered in our brains the moment, we see the words - “Sale - 50% off. Chance to exploit the dumb panicking shopkeeper”. Essentially, we love or indulge in buying businesses(stocks) at discount to their fair value as assessed from the perspective of a long-term private business owner even when buying it from the public market. But who are we buying it from, there is always someone on the other side of the trade often referred to as Mr. Market. They can close down the stock market for five years under any scenario, and it would not bother the investors truly inclined to the value investing framework. And if we do a good job of buying at a “margin of safety” or when things are on “sale”, we make a very good return on our investment that beats returns from buying other things that were “not on sale” like the broad stock market indices like NIFTY 50 or SENSEX. This market beating return over broad market indices is known as the alpha of the investor over the broad market indices.

That is, the four key things to the philosophy/framework are:

1 - Buying businesses or thinking and making decisions about businesses from the perspective of an intelligent, rational, conservative, risk averse, long-term oriented private business owner risking their own hard-earned capital.

2 - To see the stock market as a real person - Mr. Market. Essentially this is the guy who’s like the shopkeeper who is trying to sell you part of the businesses(stocks) at different prices. It is for you to decide if something is on sale or if something is overvalued. It is exactly like going and comparing prices of same things from different brands in a DMART. If something is on sale that you like relative to the other options and you need it for a long time, you are going to buy shit ton of it that day. We don’t give a rat’s ass to what Mr. Market or the salesman at the DMART thinks about the price of something I want to buy. We have an independent view as to what the intrinsic value of a business is from the perspective of a long-term owner. We will just be opportunists and take advantage of it when Mr. Market is in a panic mode if we think the prices Mr Market quotes for the business are ridiculously low. And hence we concentrate and not diversify our capital in our best ideas/opportunities.

3 - Margin of safety - No amount of knowledge or stratospheric IQ can help a person know the future. Investing is therefore a game of odds about guessing the future to some extent. What businesses will survive, what wont, who has a better chance of survival with everything that is known about history of businesses. What has led to failure. Which are the types of businesses best avoided. Even with all that knowledge, you cannot exactly predict the future. to protect against an unknown future of any business that you intend to buy with your hard-earned capital, you don’t want to overpay by leaving some margin of safety in your appraisal of the value of the business so that even if you made a wrong decision you don’t want to regret it for life.

4 - Circle of competence - Basically the easiest person you can fool is yourself in terms of the extent of your own knowledge, your level of competence and knowing what you can know and reasonably guess(never exactly predict) even with endless research/diligence/computer models. Good value investors are often to a considerable degree aware of the limits of their knowledge, abilities. Also, they often have a childlike curiosity and are intellectually humble as to what is really knowable, important. And this curiosity, intellectual humility, rationality and their inner score card I think comes first to their existence than money. They try to focus on the few key variables that truly matter in the sea of endless datapoints. And only focus on opportunities they understand well and just say “NO” to the ones they don’t.

Now coming to the main point of the article. All the money managers you read about, listen to and hear from largely tend to speak the above lingo. But like many other things in the world, it’s just marketing rather than staying true to those principles. They are just salesmen. 95%+ money managers and the analysts that work for them who manage your money including Mutual Funds, PMS Funds, etc. violate all the 4 above mentioned principles. Why? Simple - for their commission. They betray your hope of doing better in investing than the broad market indices to fill up their pocketbooks irrespective if you make or lose money in any given year. This is basically - Incentive caused bias or irrationality of equity analysts and the fund managers.

Let me simplify and start from the beginning. Think for a moment about any fund. It’s a pool of money that is not of the fund manager or its analysts. It is a very large pool on a national level and largely of people who do not understand investing or what to do with their money. They just work hard all day and earn some money but never understood or have time to learn how actually to invest it. So largely that whole pool is kind of dumb money and there is a large supply of it.

Now the right thing to do with that pool of money is to buy businesses “opportunistically” like the brilliant businessmen or capital allocators like Buffett, Munger, Pritzkers, Piramal etc. would buy as if that whole pooled money was your own hard-earned capital. Under that philosophy, you wouldn’t want to overpay, avoid some sectors outright where the probability of losing money as business owner is high given terrible business economics, and betting only when odds are in your favour vs Mr. Market.

But do fund managers behave that way? Before that, how do they make their money? What are their incentives? Largely, charge 1-2% fixed fee per year on any pool or money(Assets Under Management - AUM) they manage upfront. They make take losses that year, they may not beat the index, or they may just marginally beat it. Under all scenarios they take that 1-2% of commission up front per year no matter what happens, to manage your money, since you don’t know a damn thing about it. Best part is you as customers at large don’t understand a thing about all this and you’re happy with whatever mediocre returns you can get and if the returns are not good, there is always a reason - “the markets went down” as if it’s not the money manager’s job to not go down with it. On top of that if they perform or give returns over a hurdle rate of say 6% which they usually do given the stock markets keep going up and up, they get to pocket another 2% or so of the AUM taking their total commission to 3-4% per year. Average mutual fund manages say 10,000Cr in AUM. Think of getting 3-4% on that for virtually doing nothing. And you guys keep thinking selling Vada Pav might be a better business.

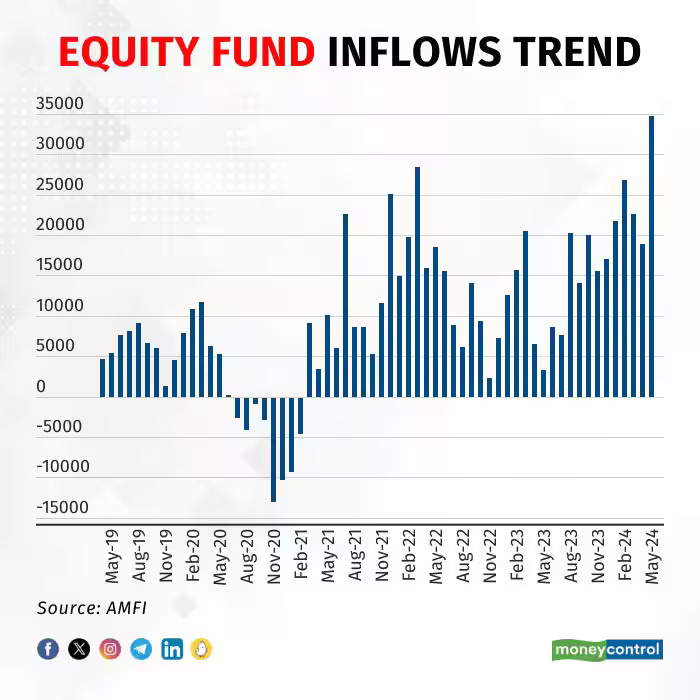

Now think of year 2024. Markets and business valuations are high. There is largely no chance to get an opportunistic buying opportunity to buy a business from the perspective of a long-term private business owner. On top of that pool of dumb money has increased a lot. That is a lot of money has flowed into the Mutual funds and other PMS funds as seen in the image below. Under such scenarios, how many fund managers say I cannot rationally allocate money as if it was my own money, so I am not going to take additional money and restrict the inflows into the fund. If he does that, he doesn’t increase his AUM. He charges a sitting on ass and doing nothing fee of 2% upfront on AUM even before giving any returns and even when there are losses. Is he going to walk away from his fee increasing by rejecting that additional money that is coming into the fund?

A very tiny number of funds walk away. But practically the way the world is set up, 95%+ fund managers are not going to walk away from that additional money coming into the fund which is going to help their own pocketbooks irrespective of the gains or losses of their customers. And if they walk away someone else is going to get that business from them and enjoy scale benefits eventually. Imagine if they were publicly listed, to walk away from that money would mean angry shareholders even if doing right job by the customers. This is the classic case of “Perverse incentives”.

So, what happens is these fund managers and their equity analysts say to themselves knowingly or unknowingly if they are dumb that we cannot do the right thing for the customers, but we got to do something anyway to fill up our pockets. Instead of being opportunistic buyers, they do anything that is just “good enough” or even at times absolutely dog shit in small parts of their portfolios. Instead of avoiding bad businesses they will still allocate some part of the money of the fund to it and diversify. In other words, instead of concentrating on best opportunistic ideas with huge margin of safety, they end up diversifying across not so good ideas.

Also, the total number of ideas/businesses in which they and their competitors can put that large pool of money into are so limited. It is not like they can put part of their 10,000Cr pool of money into a small and profitable business whose entire valuation might be 200Cr. It’s like say your net-worth is 100Rs and you decide to allocate 2% of it to something. What returns is it going to give you on the portfolio level? It can go 4x in extreme cases and still it won’t increase your net worth by even 10%. So, just like you can’t spend a lot of time thinking of such things large funds with their large pools of money cannot think of smaller opportunities.

So largely they end up looking at the same big businesses to buy which can’t really grow much that their similarly incentivised/motivated competitors are looking at with their large pools of money in an auction driven market! How can they get stocks at discount is beyond me in such a scenario instead of thinking like a small opportunistic buyer who can go in the places on the gameboard that the large competitors can’t. Classic Sam Walton strategy. For, a wise businessman knows it's in his best interest to avoid competing with the giants, fanatics, or the dumb & awash with cash who are just throwing money around in their own turfs. But these guys are not wise and don’t really want to be. They simply cannot outperform broad market indices over 10-year period. The right strategy for people that size is largely how Berkshire or Nalanda Capital(with their capital calls only at the right time) does it - few, infrequent, large bets at right time. But largely, they cannot criticize themselves or what they do. I mean who does? How many people accept their own mistakes or look at their own faults? So, in that denial, they have already relaxed their standards of how to look at valuations or being selective of businesses or industries and so on. They don’t even try to compare one business from terrible industry to a business with phenomenal economics in a different industry as a rational long-term business owner would saying “it’s not an apple-to-apple comparison”. To hell with their apple-to-apple comparisons. They are not incentivised to be great rejectors or be patient unlike the rational business owner or capital allocator making decisions on significant part of their hard-earned capital when faced with those choices for investing. I think that’s dumb. If they thought like the business owners, they would reject entire industries, would say “No” a lot more than say “yes” to. They would compare their best option/idea against all the other options and even the ones already in their portfolio and concentrate heavily in their best idea. But it’s not their hard-earned capital they manage. It’s the large dumb pool of money that’s just lying there for a star salesman of a fund manager to grab.

Their record is no better than monkeys throwing darts to select stocks in a given year due to their willingness to keep paying up and up for anything under the sun in an already efficient part of the market. These guys torture reality and use dumb Excel models to justify doing things. There is absolutely no need of Excel spreadsheets to make sound investment decisions. The more you need to use spreadsheets, the weaker are your mental models, and the weaker is your thinking & decision making. Reminds me of a line Charlie Munger once said -"Somebody once subpoenaed our staffing papers on some acquisition. And of course, not only did we not have any staffing papers, we didn’t have any staff." In money manager’s little defence, it is hard to justify being lazy in their action, while thinking deeply and waiting patiently for opportunities even if it is the right thing to do while their customers would be saying “swing you bum!”.

Basically, mutual funds and big institutional funds and even PMS funds today are dumb money. And sometimes they are so dumb that the fund managers invest their own money into their own funds. They kick out sound principles and doing right by the customers just for their fees. If that is not immoral, I don’t know what is. And the best part is people find out 5-7 years after since takes time to build a track record until that you’ve made about 10% of that large AUM(2% each year) as a commission for yourself in the worst-case scenario of you giving customers losses or just staying around or a few percentage points above the return from index on which you have made additional performance fee. There simply is no downside. You have become very rich even if your customers haven’t. Then they market themselves as value investors on their websites - “we are committed to deliver long term performance by following value principles derived from Buffett or Munger” “we think as business owners and are followers of value investment philosophies”. But the 4-year SEBI Portfolio turnover data of PMS funds in India points otherwise. Even with some capital inflows or outflows in some years, median the portfolio turnover or churn should be low averaged out over say a 4-year period if you are a long-term investor. It’s not like you are swimming in a sea of cheap opportunities today like Buffett and Munger did in 50s and 60s. A higher churn during those times was okay since you were moving from one opportunity to another which was still cheap. So, I went through the SEBI data. Out of 440 PMS funds in India only about 30 had median portfolio turnover less than 0.35 over past 4 years until FY24. In other words, all the remaining 410 did not hold stocks more than 3 years. Many less than 1.5 years. Good God! So many TRADERS who call themselves INVESTORS. On top of that only 8 funds of those 30 have an alpha of 5% consistently over the broad market index since their inception. In simple terms 8 out of 440 about 2% of fund managers in India are truly value oriented. The only ones who understand that the truly good businesses and opportunities are extremely rare in today’s world. Even if I was missing some names and that number was 16 out of 440 still not even 4% fund managers in India have a value-oriented inclination. That’s depressing. But I guarantee the percentage or people calling themselves value investors amongst those 440 will be considerably higher. Lou Simpson, Schloss, Buffett, Munger, Chuck Akre, Philip Carret, Bill Ruane, Li Lu the true value investing legends or even good owner operators like the Pritzkers’ had their turnovers consistently below 0.2-0.25 forget the 0.35 filter that I used. In other words, they invested in an average business over 4-5+ years at least.

All this irrationality always has been the case. There are many studies and books in past that have detailed this. Here are a few quotes and an article from Charlie Munger on the same:

“The whole damn system is corrupt.”

Investment managers are nothing more than “fortune tellers or astrologers who are dragging money out of their clients’ accounts, - Munger “We have people who know nothing about stocks being advised by stockbrokers who know even less,” he said, calling it “casino activity.”

“In other words, nobody can stand being that different from the crowd in results because they’re afraid of losing their fees, so they all end up doing the same thing,” he said. “It’s mildly ridiculous. The world is mildly ridiculous.”

That is where I think any fund manager who is willing to walk away from the fixed fee has the right structure. Cause his fees has to come out of performance. Look for the ones that - “Always take the high road. It's less crowded”. Naturally, to give that performance, he will have to hunt in inefficient corners of the market and limit his AUM, which mostly would mean smaller companies which the funds with larger AUMs cannot target cause there is simply no incentive to increase AUM. Cause if he increases it, it is going to hurt his returns and hence the fees. And the second thing to watch is what that fund manager did in the past. Was it logical as investments in terms of the opportunity and the quality of companies selected, how concentrated was the fund into that opportunity or was it just plain blind luck or irrational expansion due to market forces. Just like the old adage - A man is known by the company he keeps; I would say -"An investor is known by the opportunities and companies he picks". Goal is to be a business picker and not a stock picker as Buffett has said. Especially when the capital managed is large. And of course, they should restrict inflows and build up cash positions in a year like 2024 when the market cap to GDP is ridiculous. All of which should give them a sustained 5% plus alpha at least over the broad market indices over long term. This is also why, usually it’s a structural advantage to be small and running your own money. But even in the smaller parts of market today you have a lot of competition in the form of smaller funds like PMS funds having the same irrational incentives and behaviour. No wonder the small-cap and mid-cap index has outperformed in the past few years coinciding with the rise of the AUM and the number of these PMS funds.

Great Article!!